A well managed cash flow is conducive to the success of any business. You can sell product all day long, but if you can’t collect payment for that product in a timely manner, you may have to rely on other sources of cash to fund your business – which can be expensive and inevitably cut into your profits.

For starters, your organization should have a sound credit policy in place to help you accurately assess the credit worthiness of potential customers. This policy will determine the payment terms your company is willing to offer, as well as the amount of credit to extend. It should include:

- Requiring them to complete a credit application

- Calling their trade references

- Using credit agencies like Dun & Bradstreet, Experian, etc. to gather information such as: paydex score, net worth, solvency and liquidity

- If they are requesting a large line of credit, you should request their most recent financial statements

Where ERP Software Comes In

Make sure your ERP software is able to show you what your customer’s credit standing is at any time. It should also track ongoing sales activity for customers designated as needing credit hold evaluation when sales orders are entered in the system.

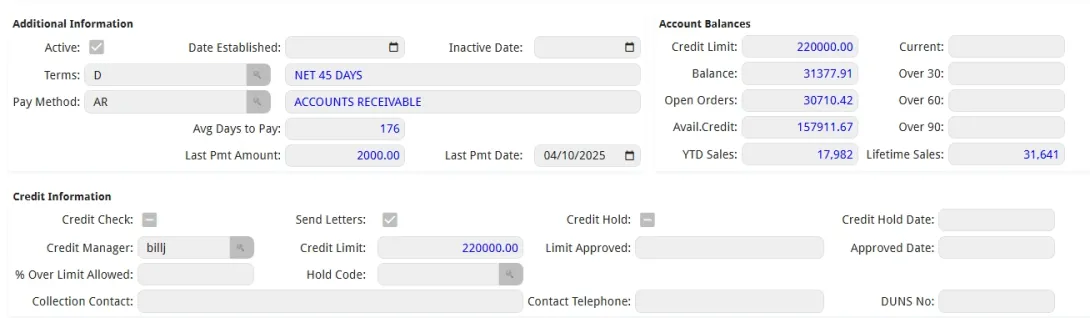

The customer information screen should show you at a glance your customer’s credit status in real-time. It should display payment terms, credit limit, aged balance due amounts and open orders, available credit, average days to pay, % over limit allowed and who to contact if there are issues with collections.

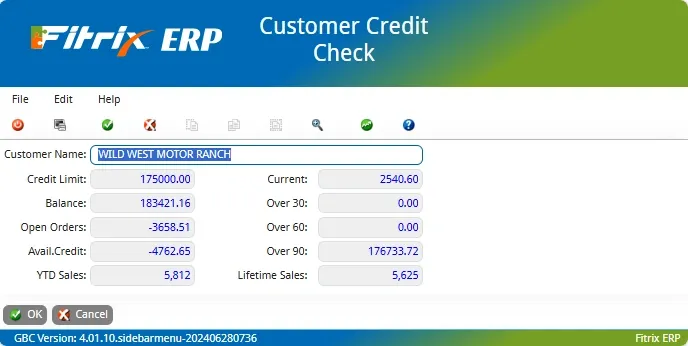

You should also be able to see a real-time comparison of balance due to credit line during Sales Order entry.

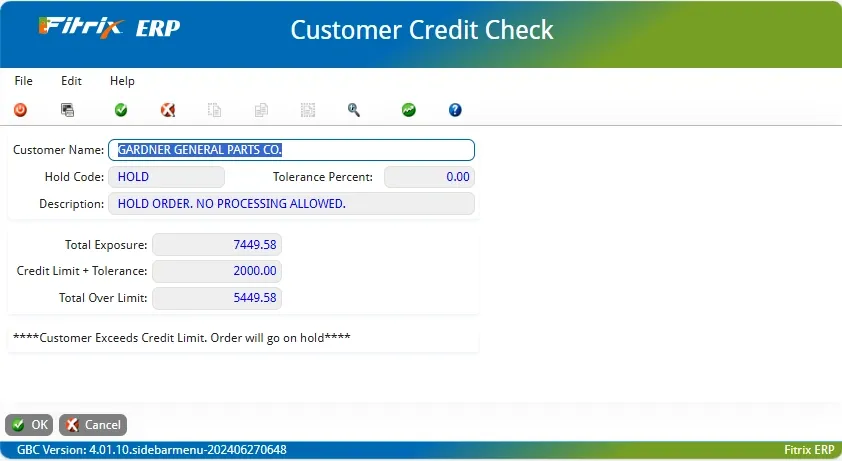

If your customer exceeds their credit limit, several things happen:

- Whoever is entering the order should be notified that it will be placed on hold.

- A copy of the order acknowledgement should be emailed to the credit manager and the sales representative assigned to the account notifying them that the order is on hold.

- The order should then be placed on hold so that it can be reviewed by your credit manager, and if need be, the customer contacted.

Just because an order has been placed on credit hold doesn’t mean that everything should stop, especially if you’re a make to order manufacturer. If you have a lengthy production processing time, you may still want to produce the item so you have it available to ship when the order is taken off hold.

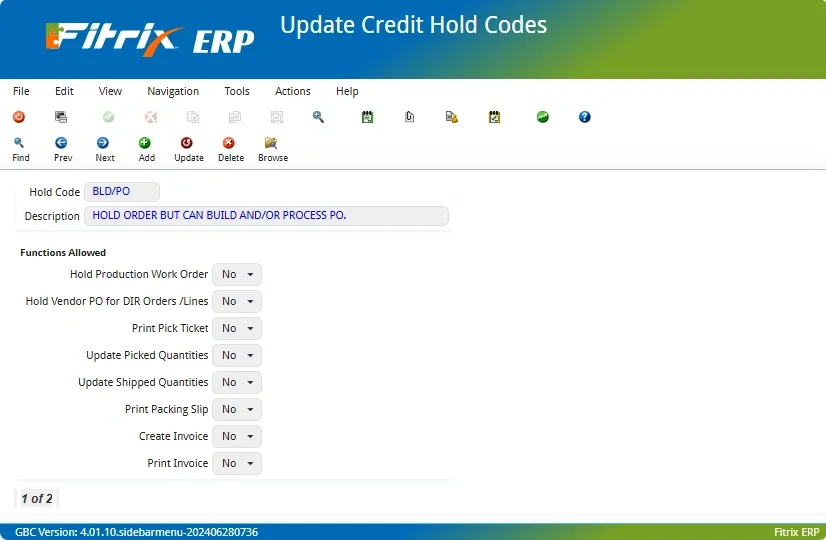

In Fitrix ERP, this is controlled via Hold Codes. Customers assigned the Hold Code “BLD/PO” shown here will not have the production work order held, but will not be able to have their order shipped until the order is released from hold.

The final step in the process is to release the order once you’ve reached a payment agreement with your customer. A report of orders on hold should be run each morning and reviewed - or have the report set up to run automatically after hours, so that it’s on your credit manager’s printer first thing every morning.

When the orders are released, an email should be sent to both the person that entered the order and the customer’s sales representative so the customer can be contacted and given an estimated delivery date. If the production work created from the sales order was also placed on hold, the person responsible for processing the work order should also receive an email so they know to proceed with production.

Credit management can certainly be tricky balancing act. You don’t want to anger your customer by putting their orders on hold, but protecting the assets of your company should be a priority. Having software in place that helps you effectively manage and track the credit status of your customers is essential to making wise credit decisions.